Special tax benefits are available for those providing daycare services for children and the parents who pay for those services. This article looks at the various tax deductions daycare providers may use and the childcare tax credit that the parents may claim.

DAYCARE Providers

Daycare providers are generally self-employed individuals who provide care in their home, and like other self-employed individuals conducting a business, they are allowed to deduct business expenses, including the following:

- Business Use of a Vehicle – Examples of business-related use of a personal vehicle by a daycare provider include taking the kids to the park, on field trips, or to the movies. Also eligible is mileage to purchase supplies and for other business-related travel. What’s deductible is the standard mileage rate (58.5 cents per business mile in 2022, up from 56 cents per mile in 2021) or the prorated business portion of the actual operating expenses for the vehicle. In either case, a contemporaneously prepared log detailing the business trips should be maintained.

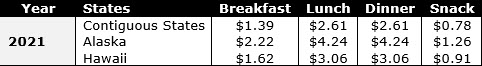

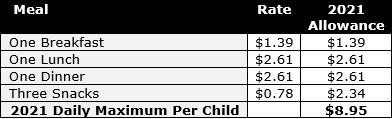

- Food – Daycare providers can deduct the cost of meals provided to the children (not including meals for their own children). Using a simplified method for the deduction does not require documenting food purchases. This does not preclude a care provider from using the actual expenses if the actual cost is higher and the provider is willing to document the expenses without including food purchased for his or her own family’s use. The simplified meal deduction amounts for 2021 are illustrated in the table below:

The rates do not include the cost of nonfood supplies (e.g., utensils), which may be deducted separately. The number of meals per day per child is limited to the amounts below. (The table uses the amounts based upon the rates for contiguous states and will be higher for Alaska and Hawaii.)

If the provider receives some form of reimbursement or subsidy, then the provider may deduct only the part of the simplified rate that exceeds the reimbursed amount.

Business Use of the Home – Self-employed individuals may take a business deduction for the business use of a portion of their home if that portion is used exclusively for business. Daycare facilities are not subject to the exclusive use requirement that applies to other home offices. However, that special rule only applies to providers who:

- Are licensed, certified, registered or approved as a daycare care provider under state law;

- Have a pending application for licensing, certification, registration, or approval under state law as a daycare provider that has not been denied; or

- Is exempt from licensing, certification, registration, or approval under state law.

Any daycare provider not meeting one of these three requirements is still subject to the exclusive use rules, which will generally prevent them from claiming the deduction unless they use some portion of the home exclusively for daycare purposes, such as a bedroom or a storage area. The daycare facility exception does not apply if the services performed are primarily educational or instructional in nature (e.g., musical instruction). However, the exception does apply if the services are primarily custodial and if the educational, development, or enrichment activities are only incidental to the custodial services. The services must be provided for individuals aged 65 or older, children, or individuals who are physically or mentally incapable of caring for themselves.

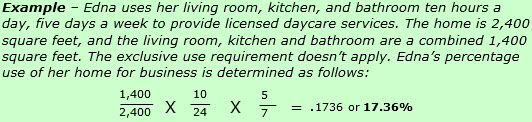

When calculating the percentage of business use of the home, both the space used to operate the daycare business and the amount of time that the space is used to provide day care, including preparation and cleaning time, are factors.

Once the percentage is determined, all the home expenses, including interest, real property taxes, home insurance, maintenance, utilities, and depreciation, are summed up and multiplied by the percentage to determine the deduction for the business use of the home. If the home is rented, the rent expense replaces the interest, taxes, and depreciation. After determining the deduction, it is further limited to the gross income from the daycare operation, and if limited by the gross income, there is a specific order in which the home expenses can be used (not discussed in this article).

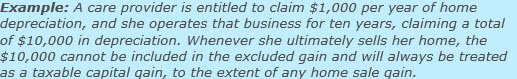

Claiming the business use of the home deduction will also impact any future sale of the home. For taxpayers who own and use their home for two years out of the five years prior to the sale, they can generally exclude up to $250,000 ($500,000 if married filing jointly) of any resulting gain. However, any depreciation claimed or that could have been claimed after May 15, 1997, cannot be excluded and, as a result, will be taxable to the extent of any gain from the sale.

- Other Expenses – Other expenses include just about any expense that has to do with operating the daycare facility, including, for example:

- Advertising

- Business banking account fees

- Daycare licensing

- Daycare organization membership expenses

- Seminars and education related to operating a daycare center

- Business insurance

- Games and toys

- Supplies, diapers, wipes, and cleaning supplies

- Covid-19 related PPE (personal protective equipment) such as masks

- Phone service

- Prorated Internet service

- Field trip expenses

- Payroll for employees

Here are some other important tax issues that apply to daycare providers:

Self-Employment Tax – Like all self-employed taxpayers, daycare providers must pay self-employment tax, which is made up of the Social Security tax of 12.4% on the first $147,000 (2022) of profit from the business and a 2.9% Medicare tax on all the profits. Plus, there is an additional 0.9% Medicare tax on the extent to which the profits exceed $200,000 for single taxpayers, $250,000 for married taxpayers filing jointly, and $125,000 for married taxpayers filing separately. In addition, half of the self-employment tax can be deducted from gross income.

Qualified Business Income Deduction – Most business owners are allowed a deduction equal to 20% of their qualified business income (QBI). This deduction is most commonly known as the pass-through income deduction because it applies to income from business pass-through entities such as partnerships and S-corporations but also includes income from sole proprietorships reporting on Schedule C of Form 1040. It is sometimes referred to as the Section 199A deduction. The computation can be quite complicated and includes limitations on the deduction at the entity level and then again when the deductions from all entities of the taxpayer are combined and is further subject to a limitation based on the taxpayer’s taxable income. While the deduction doesn’t reduce the amount of the business income on which self-employment tax is paid, it does lower the individual’s income that is subject to income tax. In many cases, this deduction can be very beneficial for a taxpayer operating a daycare business.

Retirement Plan Contributions – Profits from a daycare business qualify for IRA contributions and self-employed retirement plans, allowing daycare providers to put away substantial amounts for their future retirement.

Medical Insurance Above-the-Line Deduction – While most taxpayers must itemize their deductions to deduct the cost of their medical insurance, self-employed taxpayers – including daycare providers, to the extent of the profits from their business – can deduct the premiums from their adjusted gross income and avoid the 7.5% of AGI medical expense haircut when itemizing deductions.

Employer Identification Number – Most daycare clients can claim a tax credit for the cost of daycare. However, to do so, they must include either the daycare provider’s Social Security number (SSN) or an employer identification number (EIN) on their tax returns. It is a best practice in this age of ID theft for an individual operating a daycare business not to give out their SSN to their clients and instead obtain and use an EIN (even if they don’t have employees).

DAYCARE USER

If you use the services of daycare providers you may qualify for a tax credit if the expense is an “employment-related” expense, i.e., it must enable you or your spouse, if married, to work or look for work, and it must be for the care of a child, stepchild, foster child, brother, sister, or stepsibling (or a descendant of any of these) who is under 13, lives in your home for more than half the year, and does not provide more than half of his or her own support for the year. Married couples must file jointly, and both spouses must work (or one spouse must be a full-time student or disabled) to claim the credit.

The age restriction does not apply if the individual is disabled (isn’t physically or mentally able to care for him- or herself) and qualifies as your dependent. There are some situations when a disabled individual may qualify even if not your dependent; check with this office for details.

The child for whom you paid the care expenses must be your dependent. So, for example, if you are divorced and your ex-spouse claims your child who lives with your former spouse as a dependent, you may not claim the childcare credit even if you pay some or all of the childcare expenses. On the other hand, under a special rule for divorced or separated parents, if you are the custodial parent, even if you cannot claim the child as a dependent, you would be eligible to claim the credit for the qualified childcare expenses you paid.

The qualifying expenses are limited to your income from working and, if you are married, the expenses are limited to the lower of your or your spouse’s income from working. However, under certain conditions, when one spouse has no actual income from working and that spouse is a full-time student or disabled, that spouse is considered to have a monthly income of $250 (if the couple has one qualifying child) or $500 (for two or more qualifying children). This means the income limitation is essentially removed for a spouse who is a student or disabled all year.

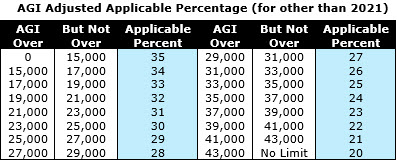

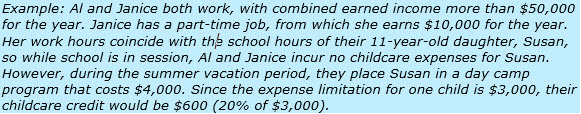

The qualifying expenses can’t exceed $3,000 per year if you have only one qualifying child, while the limit increases to $6,000 per year if you have two or more qualifying persons. (These amounts were substantially higher for 2021, but Congress has not extended the pandemic relief provisions that lead them to enhance the credit for 2021. The 2021 expenses are capped at $8,000 for one and $16,000 for two or more qualifying individuals.) If there are two children, the care expenses need not be divided equally. For example, if you paid $2,500 in qualified expenses for the care of one child and $3,500 for the care of another child, the $6,000 can be used to determine the credit. The credit is computed as a percentage of qualifying expenses – in most cases, 20%. See the table below for the credit percentages based on the taxpayer’s adjusted gross income.

For 2021 only, the credit rate for most filers was 50% of the expenses. Thus, the maximum credit was $4,000 for one qualifying child and $8,000 for two or more children (or other qualifying individuals). This increase in the credit was targeted at lower-income taxpayers, so it includes a phaseout provision whereby the 50% credit rate begins to phase out when the taxpayer’s AGI reaches $125,000 (one percentage point for each $2,000 above the $125,000 threshold), but the rate isn’t reduced below 20% until the AGI reaches $400,000, at which point the credit phaseout picks up again.

The credit will reduce your tax bill dollar for dollar. Thus, in the above example, Al and Janice would pay $600 less in taxes by virtue of the credit. However, the credit can only offset income tax and alternative minimum tax liability, and any excess is not refundable. The credit cannot be used to reduce self-employment tax, if you are self-employed, or a myriad of other taxes. Generally, the childcare credit is nonrefundable. However, for 2021, it is fully refundable if the taxpayer’s primary residence (or at least one spouse on a joint return) is in the U.S. for more than half the year.

Employer Dependent Care Benefits – Some employers provide dependent care assistance programs to help their employees with the cost of daycare. Payments under these plans used by employees to pay dependent care expenses are excludable from employees’ income, up to the lower of:

- The employee’s earned income (for married employees, this is the earned income of the lower-paid spouse) or

- $5,000 ($2,500 for married filing separate). (For 2021 only, these amounts were increased to $5,250 for married separate and $10,500 for other filing statuses.)

Because reimbursement up to these limits is excludable from income, the benefits the employee receives are treated as reimbursement for daycare expenses that reduce the expense limits of $3,000 for one child and $6,000 for two or more children. Reimbursement more than these limits is taxable to the employee and does not reduce qualified expenses for the credit.

Other Credit Criteria:

- Age of the Child – If the qualifying child turns 13 during the year, only the care expenses paid for the child for the part of the year when he or she was under age 13 qualify.

- Day Camps – Many working parents must arrange for care for their children under 13 years of age (or any age if disabled) during school vacation periods. A popular solution — with a tax benefit — is a day camp program. The cost of day camp can count as an expense toward the child and dependent care credit. But expenses for overnight camps do not qualify. Also, not eligible are expenses paid for summer school or tutoring programs.

- Both Parents Working in an Unincorporated Business – When both spouses of a married couple are jointly involved in an unincorporated business, it is common, but incorrect, for all that business’s income to be reported as just one spouse’s income. As a result, they lose the benefits of the childcare credit, which requires both spouses to have income from working. However, here are a couple of ways to remedy this situation.

- One option is to file a partnership return for the activity, in which case each spouse will receive a K-1 that reports his or her share of the net profit.

- Another approach avoids the necessity of filing a partnership return and is probably less complicated. This is done by making a qualified joint-venture election, in which each spouse elects to file a separate Schedule C for his or her respective share of the business. This gives each spouse self-employment income for the purposes of the self-employment tax and for claiming the childcare credit.

A qualified joint venture refers to any joint venture involving the conduct of a trade or business if:

(1) The only members of the joint venture are spouses,

(2) Both spouses materially participate in the trade or business, and

(3) Both spouses elect to apply this rule.

Generally, to meet the material participation requirement, each spouse will have to participate in the activity for 500 hours or more during the tax year. However, a business owned and operated by spouses through a limited liability company (LLC) does not qualify for the qualified joint venture election.

- School Expenses – Only school expenses for a child below the kindergarten level are considered qualifying expenses for this credit.

- In-Home Care Providers – If the daycare is provided in a taxpayer’s home, the daycare provider is considered a household employee. If you are a household employer, you may have to withhold and pay Social Security and Medicare tax as well as pay federal unemployment tax and issue the caregiver a W-2 form. However, if the caregiver provides the services in his or her home, the caregiver would not be considered your household employee.

- Records Required – To claim the credit on your tax return, you will need to provide the care provider’s name, address, and tax ID number. No credit is allowed without that information. If you have more than one child who qualifies you for the childcare credit, you must also show the expenses paid for each child, up to the $6,000 total maximum allowance. If your state allows a childcare credit, additional information, such as the care provider’s phone number, may be required.

This has been an overview of the various tax issues related to daycare from the perspectives of both the provider and the recipient of daycare services. However, as in everything taxes, many more rules and issues exist than could be included in this article.