Generally, individuals are required to file a tax return for a year if their income exceeds the standard deduction for their filing status for that year. But even if they are not required to file it may be beneficial to do so. They could be missing out on huge refunds.

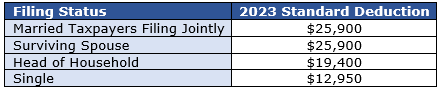

The standard deduction is inflation adjusted each year and the table illustrates the standard deductions for 2023.

There are two exceptions: married individuals filing separately must file if their gross income is $5 or more and self-employed individuals must file if their gross self-employment income is $400 or more.

Additional amounts are added to the amounts above for each filer (and spouse if filing jointly) who is age 65 and over or blind. These additional amounts are $1,500 for married individuals filing jointly and a surviving spouse; $1,850 for others.

Just because someone is not required to file a return does not mean they shouldn’t. Failing to file a return could end up leaving large sums of money on the table. Here are some examples.

- Tax Withholding – Most individuals who have wage income also have federal income tax withheld on their earnings. That withheld tax would be 100% refundable if the worker isn’t required to file a return.

A tax credit is a dollar-for-dollar offset against the tax liability. Some credits can only reduce a tax liability to zero, while others as discussed below are refundable, meaning if the credit is more than the individual’s tax any excess credit is refundable. So if an individual is not required to file and therefore owes no tax and qualifies for one or more refundable credits, it may be in their best interest to file and take advantage of the credit(s).

- Earned Income Tax Credit (EITC) – The EITC is for people who work but have lower incomes. If you qualify, it could be worth up to $6,935 in 2022. The credit is a fully refundable credit, so individuals can receive the full amount of the credit even if they do not owe any taxes.

If you were employed for at least part of 2022, you may be eligible for the EITC based on these general requirements and earned less than:

- $16,480 ($22,610 if married filing jointly) and have no qualifying children.

- $43,492 ($49,622 if married filing jointly) and have one qualifying child.

- $49,399 ($55,529 if married filing jointly) and have two qualifying children.

- $53,057 ($59,187 if married filing jointly) and have more than two qualifying children.

- Child Tax Credit (CTC) – This is a per child credit that phases out for higher income taxpayers but is available to all categories of taxpayers that are not required to file. The full credit is $2,000 per child, but the refundable amount is limited to a maximum amount of $1,500 for 2022 ($1,600 for 2023).

- American Opportunity Tax Credit (AOTC) – The AOTC provides a credit of up to $2,500 per year per eligible student with higher education expenses. Up to 40% of the AOTC is refundable, even when there is no tax liability. Thus, it can result in a refund of as much as $1,000 (40% of $2,500).

Generally, an eligible student for the AOTC can bethe filer and spouse and their dependents that are enrolled at an eligible educational institution for at least one academic period (semester, trimester, quarter) during the year.

If someone other than the filer, a spouse or their claimed dependent directly makes a payment to an eligible educational institution for a student’s qualified tuition and related expenses, then the filer is treated as paying the expenses and qualifies for the credit. Thus even if not required to file, individuals could still have a refund in the thousands of dollars. The IRS has indicated that about 25% of those eligible for the EITC fail to claim it. Individuals should not miss out on the refundable credits simply because they are not required to file.