On August 16, 2022, President Biden signed into law the Inflation Reduction Act of 2022 which is a scaled-back version of the prior Biden administration proposals originally included in the Build Back Better Act. The legislation includes a variety of provisions, including substantial green energy incentives, reduction of Affordable Care Act insurance premiums, IRS funding, corporate minimum tax, and more. This article will explore how these provisions will impact individual taxpayers.

Increased Internal Revenue Service (IRS) Funding – The IRS has been underfunded for years resulting in inadequate customer service causing extensive waits to speak with an agent to solve issues with the IRS, and substantially reduced enforcement activities.

Although some of the $79.6 billion supplemental appropriations will go towards improving customer service, the bulk of the appropriation will go towards increased enforcement, according to the Congressional Research Service. However, Treasury Secretary Janet Yellen has indicated the additional funds will not be used to increase audits of people making less than $400,000 above historic levels.

Drug Pricing – The legislation permits Medicare to negotiate lower drug prices (up to 10 drugs in 2026, another 15 in 2027 and 2028, and another 20 annually starting in 2029) and puts a cap on annual out-of-pocket costs at $2,000.

Affordable Care Act Insurance Premiums – The previously enacted American Rescue Plan temporally included enhanced subsidies for people buying their own health coverage on the Affordable Care Act Marketplaces for the years 2021 and 2022. The Inflation Reduction Act has extended those subsidies for three years, through 2025. These enhanced subsidies increase the amount of financial help for low and middle-income individuals, many of whom were previously priced out of health insurance coverage.

Corporate Minimum Tax – As a fundraiser to help pay for the other provisions, the legislation includes a new corporate minimum tax of 15% that would be imposed on corporations with an average book income of over $1 billion. This provision is projected to raise $258 billion over 10 years.

Excise Tax on Corporate Stock Buybacks – Stock Buybacks are when a company purchases its own shares, resulting in fewer outstanding shares. This tends to benefit corporate executives rather than raising worker wages, research and development, and other productivity-boosting investments. The legislation imposes a 1% tax on stock buybacks. This provision is projected to raise $74 billion over 10 years.

Home Solar Energy Credit Extended and Increased – Before the passage of theInflation Reduction Act, a resident of a home was entitled to a non-refundable tax credit for the use of solar electric panels, solar hot water, fuel cells, small wind energy, geothermal heat pumps, and biomass fuel property they had installed for the residence. However, that credit was in the process of being phased out by slowly reducing the credit percentage from 30% to 22%, and the credit was scheduled to end after 2023. With this law change, the credit retroactively returns to 30% for the years 2022 through 2032 when it again begins to phase out and ends after 2034. This means those who qualify for the credit in 2022 benefit from a 30% credit rather than the expected 26% under prior law.

Credit For Energy Efficient Home Modifications – This provision provides a non-refundable tax credit for certain energy-saving improvements to a taxpayer’s home. The credit previously expired at the end of 2021, but under the Inflation Reduction Act has been extended and modified through 2032.

The previous lifetime credit limit of $500 has been replaced with an annual maximum credit of $1,200, and the credit percentage increased from 10% to 30%. Although not a complete list, the following are credit limits that apply to various energy-efficient improvements:

- $600 for credits with respect to residential energy property expenditures, windows, and skylights.

- $250 for any exterior door ($500 total for all exterior doors).

- $300 for residential qualified energy property expenses

- Notwithstanding these limitations, a $2,000 annual limit applies with respect to amounts paid or incurred for specified heat pumps, heat pump water heaters, and biomass stoves and boilers.

- The $1,200 credit amount increased by up to $150 for a home energy audit. A home energy audit is an inspection and written report with respect to a dwelling unit located in the United States and owned or used by the taxpayer as the taxpayer’s principal residence, which identifies the most significant and cost-effective energy efficiency improvements with respect to such dwelling unit.

- The new law eliminates treatment of roofs as creditable after 2022

- The new law adds Air sealing insulation as a creditable expense.

Under the new law, the one making the improvements and claiming the credit need only be a resident of the home and not necessarily the owner.

Clean Vehicle Credit – After 2022 and through 2032, this credit replaces the current plug-in electric vehicle credit and makes significant changes.

Transition Rule: A taxpayer who, after December 31, 2021, and before August 16, 2022, purchased, or entered a written binding contract to purchase, a new electric vehicle and placed that vehicle in service on or after the date of enactment, may elect to treat the vehicle as being placed in service before the date of enactment of the Act. This transition rule allows a taxpayer to apply the prior law to the vehicle. This allows a taxpayer to avoid the modified AGI (income), vehicle price, and other restrictions under the new law.

Credit Amount –Is based upon two amounts (certified by the qualified manufacturer):

- Critical Minerals – This portion of the credit is $3,750 and is based upon the percentage of the value of the applicable critical minerals contained in the battery that were:

- Extracted or processed in the United States or in any country with which the United States has a free trade agreement in effect, or

- Recycled in North America

Is equal to or greater than the applicable percentage (see applicable percentage below).

- Battery Component Requirement -This portion of the credit is $3,750 based upon the percentage of the value of the components contained in the battery that is used in the vehicle that were manufactured or assembled in North America is equal to or greater than the applicable percentage (see applicable percentage below).

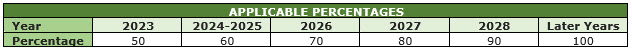

Applicable Percentage –The applicable percentages for each year are included in the following table:

Final Assembly Requirement – The Act also requires that final assembly of the vehicle occurs in North America. “Final assembly” means the process by which a manufacturer produces a new clean vehicle at, or through the use of, a plant, factory, or other place from which the vehicle is delivered to a dealer or importer with all component parts necessary for the mechanical operation of the vehicle included with the vehicle, whether the component parts are permanently installed in or on the vehicle. The final assembly requirement applies to vehicles sold after the date of enactment, August 16, 2022.

Not all Vehicles Will Continue to Qualify – Because of the critical mineral, battery, and final assembly requirements, only some of the currently available vehicles will continue to qualify for the new credit.

Manufacturer Limitation – The 200,000-unit manufacturer limit is eliminated for vehicles sold after December 31, 2022.

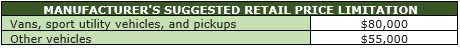

Manufacturer’s Suggested Retail Price Limitation – No credit is allowed for a vehicle with a manufacturer’s suggested retail price more than the following:

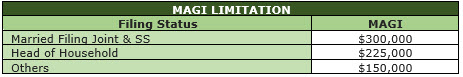

MAGI limit – No credit is allowed for any tax year if the lesser of the modified adjusted gross income (MAGI) of the taxpayer for the:

- Current tax year, or

- The preceding tax year

Exceeds the threshold amount as indicated in the table below:

MAGI means adjusted gross income increased by any foreign earned income and housing exclusions and excluded income Guam, American Samoa, the Northern Mariana Islands, and Puerto Rico.

New Clean Vehicle Definition –

- Minimum battery capacity: 7 kilowatt-hours, up from 4 kilowatt-hours under prior law.

- Where the seller of the vehicle furnishes a report to the buyer and the IRS that includes:

- The name and taxpayer identification number of the buyer;

- The vehicle identification number (VIN) of the vehicle, unless, by U.S. Department of Transportation rules, the vehicle is not assigned a VIN;

- The battery capacity of the vehicle;

- Verification that the original use of the vehicle commences with the taxpayer; and

- The maximum Clean Vehicle credit allowable to the buyer with respect to the vehicle.

- The term “new clean vehicle” does not include any vehicle placed in service after December 31, 2023, where any of the components contained in the battery of the vehicle were manufactured or assembled by a foreign entity of concern.

- The term “new clean vehicle” includes any new qualified fuel cell motor vehicle that also meets the final assembly and report requirements.

Transfer of Credit to The Dealer – A taxpayer on or before the purchase date, can elect to transfer the clean vehicle credit to the dealer who the taxpayer is purchasing the vehicle in return for a reduction in purchase price equal to the credit amount.

Making the election cannot limit the use or value of any other dealer or manufacturer incentive to buy the vehicle, nor can the availability or use of the incentive limit the ability of the taxpayer to make the election.

A buyer who has elected to transfer the credit for a new clean vehicle to the dealer and has received a payment from the dealer in return but whose MAGI exceeds the applicable limit is required to recapture the amount of the payment on their tax return for the year the vehicle was placed in service.

Credit For Previously Owned Clean Vehicles – A qualified buyer who acquires and places in service a previously owned clean vehicle after 2022 and before 2032 is allowed an income tax credit equal to the lesser of:

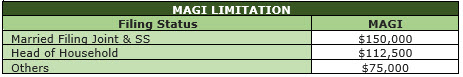

MAGI limit – No credit is allowed for any tax year if the lesser of the modified adjusted gross income (MAGI) of the taxpayer for the:

- Current tax year, or

- The preceding tax year

Exceeds the threshold amount as indicated in the table below:

MAGI has the same meaning as for the clean vehicle credit.

Previously Owned Clean Vehicle – A previously owned clean vehicle is a motor vehicle:

- Model year of which is at least two years earlier than the calendar year in which the taxpayer acquires it.

- Original use of which starts with a person other than the taxpayer,

- Acquired in a qualified sale, and

- Generally meets the requirements applicable to vehicles eligible for the clean vehicle credit for new vehicles or is a clean fuel-cell vehicle with a gross weight rating of less than 14,000 pounds.

Qualified Sale. A qualified sale is a sale of a motor vehicle:

- By a dealer,

- For a price of $25,000 or less, and

- Which is the first transfer since the Act’s enactment to a qualified buyer other than the original buyer of the vehicle.

Qualified Buyer. A qualified buyer is an individual who:

- Purchases the vehicle for use and not for resale,

- Is not a dependent of another taxpayer*, and

- Has not been allowed a credit for a previously owned clean vehicle during the three-year period ending on the sale date.

* Even if they have sufficient income to be required to file. Makes no difference if the parent chooses not to claim the child, since the dependency deduction is still “allowable” to the parent.

Transfer of Credit – Follows rules like Clean Vehicle credit transfer rules for vehicles acquired after 2023. Purchasers of previously owned clean vehicles can elect up to the time of sale to transfer the credit to the selling dealer in exchange for cash, or partial payment or a down payment on the vehicle in an amount equal to the credit otherwise allowable to the buyer.

Credit For Qualified Commercial Clean Vehicles – The Inflation Reduction Act of 2022 adds a general business credit for qualified vehicles acquired and placed in service after December 31, 2022, and before 2033.

Credit Amount – The per vehicle credit is the lesser of:

- 15% of the vehicle’s basis (30% for vehicles not powered by a gasoline or diesel engine) or

- The “incremental cost” of the vehicle over the cost of a comparable vehicle powered solely by a gasoline or diesel engine.

Maximum Credit – The maximum credit per vehicle is:

- $7,500 for vehicles with gross vehicle weight ratings of less than 14,000 pounds, or

- $40,000 for heavier vehicles.

Qualified Commercial Clean Vehicle

- Acquired for use or lease by the taxpayer, and not for resale.

- Manufactured for use on public streets, roads, and highways, or be “mobile machinery.”

- Have a battery capacity of not less than 15-kilowatt hours (7-kilowatt hours for vehicles weighing less than 14,000 pounds) and

- Charged by an external electricity source.

- Qualified commercial fuel cell vehicles are also eligible for the credit.

- Must be depreciable property.

- Made by qualified manufacturers, who have written agreements with and provide periodic reports to the Treasury, can qualify.

Research Credit – The legislation increases the limitation on the ability of small businesses to claim the research credit against payroll taxes from $250,000 to $500,000. This information related the Inflation Reduction Act is preliminary and, in some cases, will require further IRS guidance and regulations. Watch for additional detail in future articles.